Get a free customized

quote.

Our talented risk managers will reach out to you after receiving your information. If you need a consultant as soon as possible, give us a call and we will help by utilizing our proprietary techniques to help you or your business.

Solutions That Go Beyond Insurance

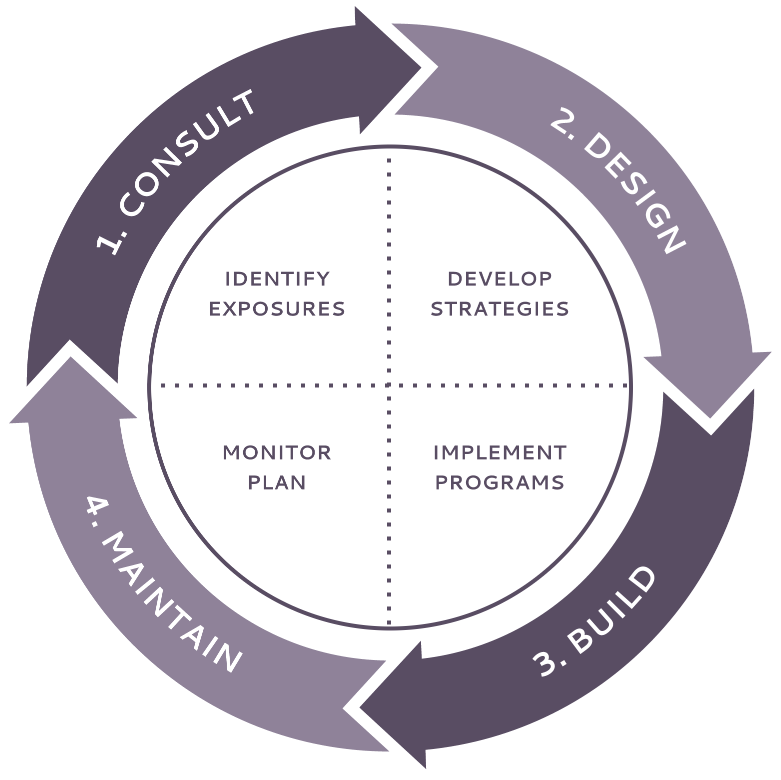

Our RISK SHIELD® Process is specifically designed to increase profits and productivity while decreasing long-term cost of insurance. During our strategic four step process, we’ll work with your team to help you identify the unique risks your business faces, then develop the strategies to overcome them. We’ll implement programs that produce results while continuing to monitor the plan and being here when you need us most. See the difference.