Multiple Employer Welfare Arrangement

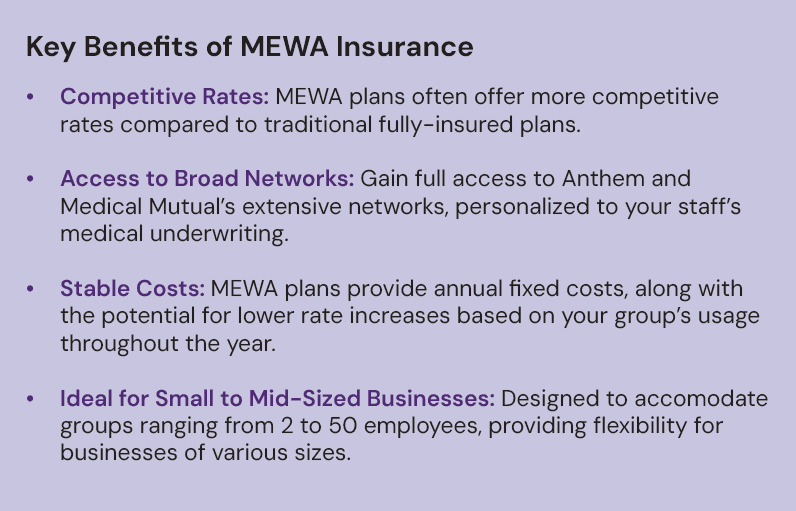

Multiple Employer Welfare Arrangements (MEWAs) have been an active force in the employee benefits landscape since the 1970s, making health plans more flexible, accessible, and supportive for workers and their families. Unlike alternative group plans, MEWAs bring employers together for a common purpose – leveraging collective power to secure quality, cost-effective healthcare coverage through risk-sharing pools.