What is the RISK SHIELD®?

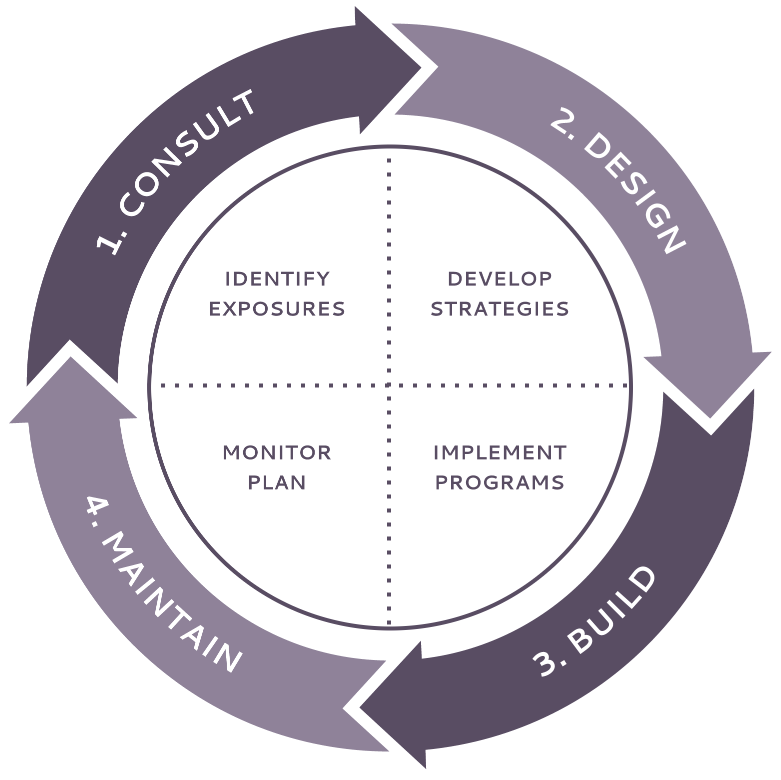

The RISK SHIELD® Process is a four-step process used by Gilbert’s to identify, understand, implement and monitor risk management strategies for you and your business.

1. Consult

During this initial phase, we will invest the time to understand every facet of your business to help you and your team identify the risks facing your business. By evaluating the effectiveness of risk management programs, practices, and resources under “real world” conditions, we assure that your assets receive precisely the right type of protection.

2. Design

Once we have developed a thorough understanding of your business, including your industry, corporate culture and operating procedures, we are ready to move BEYOND INSURANCE, exploring a spectrum of proven alternative strategies to minimize risk and reduce insurance costs.

3. Build

During the implementation process, we put tailored programs and strategies in place specially designed to protect your assets while reducing insurance costs. A strong belief in our process motivates underwriters to offer much lower insurance costs on your behalf.

4. Maintain

You and your business are dynamic – what works for you today might not work as well tomorrow. For this reason, we will continue to monitor and adjust your risk management programs to ensure a perfect fit as your business evolves and changes. This is where our comprehensive understanding of your business can pay huge dividends, by enabling us to precisely tailor your protection to fit the unique needs of your business.

The journey begins with a formal Risk Management Audit focusing on exposure identification and risk mitigation. The result is reduced claims frequency and a lower total cost of risk.

The difference is in steps 1 and 2.

The majority of agents only focus on step 3, Insurance Procurement. This is a common pricing trap for insurance policies.

RISK SHIELD® takes the time to identify and understand your unique risk. By focusing on steps 1 and 2, we’re able to offer:

- Preferred Premiums

- Non-Insurance Solutions

- Fewer Claims

Our process has been proven to be the most effective method in attaining preferred rates from insurance companies. Let Gilbert’s do the heavy lifting and focus our efforts on improving your risk profile vs. selling you insurance.

- Involved and supportive management

- Exceptional safety and risk management culture

- Proactive safety policies, procedures and controls

- Focused training and orientation programs

- Improved claim experience

Shield your success 365 days a year.