05 Nov Cyber Liability

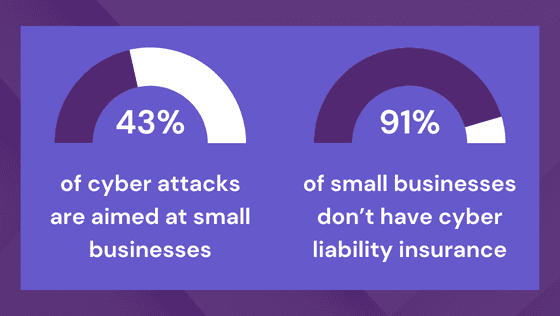

In today’s digital landscape, cybersecurity has become a paramount concern for businesses of all sizes. The rapid increase in cyber-related incidents has left many organizations vulnerable to attacks, with potentially devastating consequences. As cyber attack risks have surged significantly over the past two years, it’s crucial for businesses to understand and mitigate their cyber risks.

The Reality of Cyber Threats

Workers’ compensation is a type of insurance that provides medical coverage or cash benefits to employees who are injured or become ill as a direct result of their employment. It’s important to note that filing a workers’ compensation claim does not assign fault to the employee or employer; coverage is provided regardless of fault. Exceptions include injuries caused by impairment due to drugs or alcohol, or intentional self-harm or harm to others. Covered accidents include:

- 60% of small to midsize companies go out of business within six months of a cyber attack.

- The average cost of a data breach to businesses, regardless of size, is $3.8 million.

- Surprisingly, around 36% of small businesses express no concern about cyberattacks.

These numbers highlight the importance of cybersecurity measures and comprehensive cyber liability insurance.

Do I need Cyber Insurance?

While understanding your risks is the first step, protecting your business through cyber liability insurance is equally important. Here’s why:

- Financial Protection: With the average cost of a data breach in the millions, cyber liability insurance can help cover some of these potentially crippling expenses.

- Business Continuity: Given that 60% of small to mid-size businesses fail within six months of an attack, insurance can provide the support needed to maintain operations.

- Reputation Management: Cyber liability policies often include coverage for public relations efforts to mitigate reputational damage following a breach.

- Legal Support: In the event of a data breach, you may face legal challenges. Cyber liability insurance may be able to cover the cost of some legal fees and settlements.

By identifying and addressing risks proactively, businesses can implement effective risk management strategies not only to prevent costly claims but also to protect sensitive data, and ensure long-term resilience. If the protection of your business and data/information is important to you, you may want to assess where your risks lie.

Our Intelligent Quotient for Risk Management is a non-invasive, less than 5-minute assessment that you can complete to see where your business stands regarding how effectively it handles cyber risks. Upon completing the assessment, you will receive a free evaluation score.

We are here for you for all your insurance needs.

To discuss your options, contact one of our talented Risk Advisors today!

No Comments