15 Mar Experience Rating Plan Changes

About The Author

Kolten Hoffman, CIC, CRM, CRA – Business Risk Advisor

Kolten Hoffman, CIC, CRM, CRA – Business Risk Advisor

As a Business Risk Advisor, Kolten works in both sales and service, generating new business opportunities while delivering personalized solutions to address our clients’ multifaceted challenges.

It has been almost twenty years since the Experience Rating Plan (ERP) underwent changes in Pennsylvania, but the Pennsylvania Insurance Commissioner has now approved significant revisions. These changes, submitted by the Pennsylvania Compensation Rating Bureau (PCRB), aim to enhance the functionality of the experience modification (mod) and more accurately reflect an employer’s loss experience factor. The alterations, effective from April 1, 2024, will broaden the pool of qualifying employers for experience rating, impacting businesses throughout the state.

The approved changes seek to create a more equitable formula where top performers receive improved mods, and underperformers face more significant adjustments. Those in the middle are expected to experience minimal impact.

Here are the key components that are changed in the new plan:

Eligibility Requirement:

- The minimum premium requirement is being reduced to $5,000 from $10,000.

- The premium requirement is based on premiums developed by audited payrolls or other exposures of the experience period, which are extended at current PCRB loss costs.

- The premium requirement for Merit Rating will be for risks that generate less than $5,000 on the same basis as stated above.

Split Point/ Loss Limit:

- That plan will have variable Split Points based on Expected Loss amounts ranging from $10,000 to $300,000.

- This differs from the current plan, which used a single parent Split Point of $42,500 for all Expected Loss amounts.

Credibility Values:

- With the change to variable Split Points, credibility was increased generally for all sizes of risks ranging in value from 69% to 97%.

Capping Rules:

- A Maximum Modification formula will be used with a starting value of 1.10 and increase as a function of Expected Losses.

- In addition, any other larger single-year increases will be limited in cases where the indicated modification or the Maximum Modification results in a change above +40% compared to the prior modification factor.

- In these situations, the final published modification factor will be the resulting modification factor capped at 40% above the prior modification.

- Current capping rules limit the experience mod to a 25% increase from one year to the next.

- The capping increase from 25% to 40% will not go into effect until April 1, 2026.

Why Does This Matter For Business Owners?

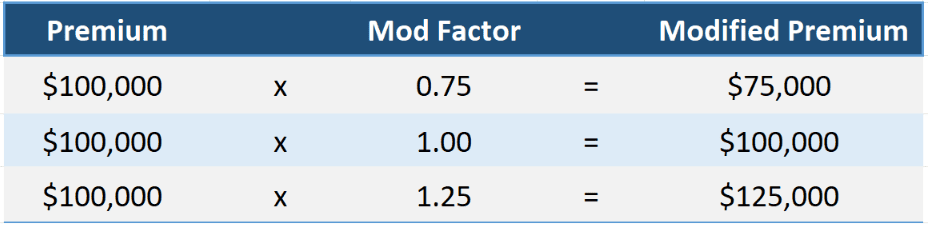

It’s important for business owners to understand where their experience modification factor ranks. This is because it directly impacts workers’ comp insurance premiums. See below for an example.

Unsure how to navigate these changes? Contact one of our talented Risk Advisors today!

No Comments