26 Apr Workers’ Compensation Insurance: Then and Now

The principles behind workers’ compensation insurance aren’t new. Dating back as far as the Sumerians, laws provided compensation for particular injuries. Later, the Greeks, Romans, and the Chinese also compensated workers for injuries, including impairments and disabilities. Let’s dive deeper into the history of workers’ compensation insurance.

Early Law Favored Employers

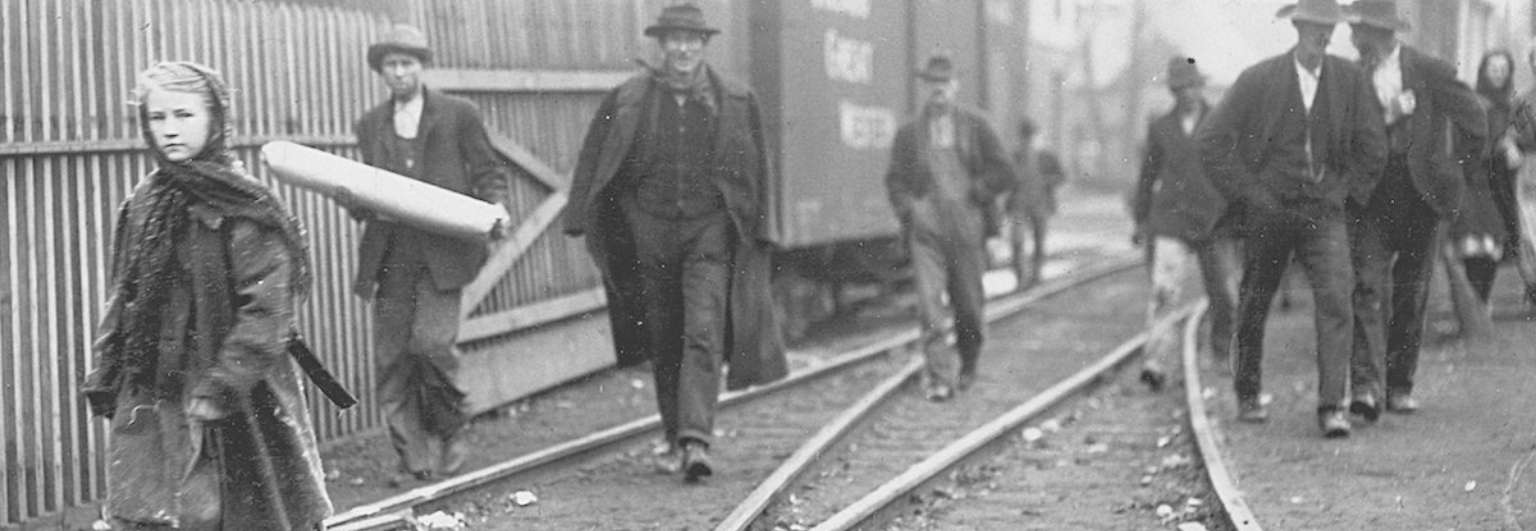

The Industrial Revolution increased hazards and workplace injuries. However, employers rarely offered compensation. Workers had to resort to the courts.

Unfortunately, laws did little to protect workers and favored the employer in many ways. If the employer could prove the worker’s actions led to his injury, even if the conditions were extremely hazardous and the worker simply had an unfortunate slip, the employee would not receive compensation.

The employer was not required to pay compensation if a fellow employee caused a worker’s injuries either, regardless of the reasons behind their actions. Finally, the law presumed employees assumed risk when they entered into their employment contract, and some employers included a clause extinguishing the employee’s right to sue.

Pragmatic Outlook Spurs Change

Public pressure in Prussia spurred Chancellor Otto von Bismarck to rethink protection for workers. Realpolitik dogma focused on practicality and protecting workers in key industries such as railroads, mining, quarries and factories made sense.

Bismarck created the Employers’ Liability Law of 1871 and Workers’ Accident Insurance in 1884, laying the groundwork for today’s Workers’ Compensation system.

Coming to America

America was much slower to embrace the concept of workers’ compensation insurance, but in 1906 Upton Sinclair published a novel depicting the horrible conditions in Chicago slaughterhouses. The public reacted strongly and demanded reform.

Several states tried to pass workers’ compensation laws but failed. By 1906, Congress enacted the Employers’ Liability Act to protect and compensate railroad workers injured on the job and further strengthened the Act in 1908.

Wisconsin successfully adopted the first state no-fault system in 1911. Employees no longer had to prove employer negligence and could receive benefits for lost wages, disabilities, retraining, and medical treatment. By accepting benefits, employees forfeited their right to sue employers. The remaining 49 states followed suit over the next 37 years.

Gray Areas of the ADA

The basics of state workers’ compensation systems had not seen much change until the Americans With Disabilities Act of 1990. Driven by the need to increase the employability of disabled Americans, the Act now required employers provide “reasonable accommodation” for workers with disabilities.

Unfortunately, the admirable intentions of the Act did not provide legal standards for what constitutes “reasonable.” Consequently, many employers fear that employing disabled workers could lead to high costs for unpredictable situations.

The Act does not define disability clearly, either. Employers can struggle when hiring because they do not know whether accommodations apply to a potential employee, and they do not have access to medical records before they offer employment.

Not surprisingly, the many gray areas in the Act often lead to lawsuits. The most common lawsuits include work-related issues with back pain, neurology, and mental illness.

Double Jeopardy

In some cases, even when employees receive a workers’ compensation settlement, they file a lawsuit for wrongful termination under the ADA, claiming the employer should rehire them with accommodation.

The roots of workers’ compensation included tort relief so employees could not sue if they received benefits. Now, employers fear they’ll pay benefits, face a lawsuit, and accommodation costs. It is more important than ever for employers to rely on good legal counsel and superior worker’s compensation risk management techniques.

Our long track record and commitment to excellence in workers’ compensation coverage has served Pennsylvania business well for over 160 years. Our skilled, experienced risk managers can help clarify gray areas and reduce your company’s risk. We’re local and reliable and easy to talk to, so contact us to discuss your insurance needs.

No Comments